A Seafarers Guide to Selling Spanish Property

- Authors

-

-

- Name

- Patrick Maflin

-

Image source: https://pixabay.com/photos/villa-joyosa-spain-celebration-2827768/

With the price of housing in Spain, and more specifically Mallorca on the rise and with growing numbers of mariners investing in property, we are finding an increasing number of enquiries relating to the effects of the sale of Spanish property in terms of taxation.

With this in mind, and as a follow up to our recent article ‘A Seafarers Guide to Buying Property in Spain’, we now bring you a quick guide to selling your Spanish property with focus on the taxes you may be subject to and how to minimise their effects.

Read on to find out more or click a jump menus below to skip to a chapter that interests you.

Chapters

- The Rising Value of Spanish Property

- Capital Gains Tax

- Plusvalia

- Primary Residence

- What Costs Can I Offset?

- Renovations & How to Arrange Your Property Business

- Speak to Us or Comment!

The Rising Value of Spanish Property

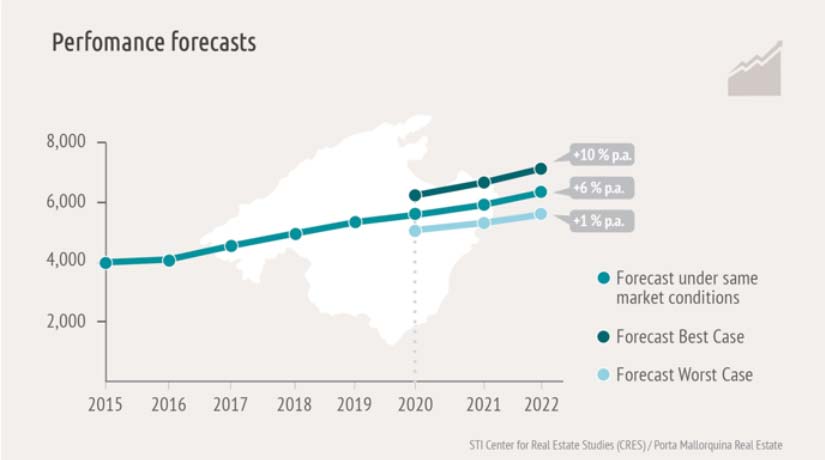

The pace at which the price of housing in Mallorca is increasing is demonstrable through the fact that the average price per square metre for holiday properties is estimated at €5,400; around 8% higher than just one year earlier.

The graph below, taken from the Centre for Real Estate Studies in Mallorca, demonstrates the increase in housing prices since 2015 as well as their own projection for pricing up to 2022.

Whilst these figures could present the fact that buying property in Mallorca at this time last year may well have been a shrewd investment, this type of rapid rise in value will also bring with it some concerns in relation to potential taxation upon the sale of the property.

As the value of the property rises, the likelihood of Capital Gains Tax (CGT) being imposed will follow suit.

But all is not lost.

There are measures which can be taken in order to minimise your exposure to this type of taxation.

Capital Gains Tax

Capital Gains Tax (CGT) is effectively a tax upon the profit you’ve made on a house or any other type of capital asset.

The sale price minus the original cost, as well as any other expenses incurred in the process of buying and selling the property.

The costs involved in selling such an asset, such as the cost of estate agency and legal fees are eligible to be deducted before the calculation is made.

The rate of CGT in Spain will vary between 19% and 23% dependent on the size of your gain.

With an additional retention charge applied to those sales when the vendor is deemed to be a non-resident of Spain.

The rules applied after January 2010, dictate that non-resident vendors will be forced to pay the 3 % retention on the sale of their properties, if they do not prove that:

- You are living in Spain for more than 6 months each year, with evidence provided in the form of a certificate of residence.

- You are declaring your worldwide income and paying Spanish taxes.

- You are able to present a certification from the Spanish customs office.

Image source: https://pixabay.com/photos/madrid-spain-road-plaza-del-callao-3021998/

Plusvalia

Plusvalia is a local land tax applied when selling Spanish property with the calculation dependent on the value of the land, excluding buildings, size of the local population and the duration of land ownership and local legislation.

In simple terms, plusvalia is a tax upon the increase of the value of the land on which your property has been built, with the difference in value calculated between the point of purchase and the point of sale.

The amount to be paid will vary regionally and be confirmed by the local authorities once the property has been

sold.

Primary Residence

"My colleague said if I declare my property to be my primary residence, I don’t have to pay tax, is this true?"

Under current legislation the Spanish tax authorities will allow CGT exemptions to those who are in the process of selling a property which has been their main residence for the last 3 years.

That's providing you have also been a Spanish tax resident for those last 3 years and the capital is reinvested in to a new Spanish primary residence for which you reside for the next 3 years.

It is easy to see why you may now ask yourself whether the best option in these circumstances, in terms of reducing your liability, would be to declare the property as your primary residence when the time does come to make the sale.

Declaring a property which you have not treated as your home to be your primary residence will be viewed by most tax authorities as tax evasion, with financial penalties as well as prison time imposed in some cases.

What Costs Can I Offset?

When developing or renovating your property you may be eligible to offset these costs, decreasing your tax liability.

It is important to understand however, that the costs must be officially signed off by a notary with correct invoices and VAT paid.

In certain cases, the authorities may also allow you to offset the cost of making your land 'buildable'.

It is also important to ensure that you have the correct building licences confirmed and registered with the land registry.

Renovations & How to Arrange Your Property Business

The first and most important point to make is that this may not always be a viable option and advice seeking advice from a professional would always be recommended before placing your property in the ownership of a company.

The most common business entity to set up and get your Spanish company up and running is the Sole Trader or Empresario Individual.

In this type of arrangement, the business and the individual in control are viewed to be the same entity for legal purposes.

For that reason, the business owner does not have to file any special tax forms come tax time, only the standard Impuesto sobre la Renta de las Personas Físicas (IRPF), which you should be filing anyway with the owner left responsible for all debts incurred by the company.

If you are planning to undertake large renovation work, there may be considerable benefits in forming a Spanish “SLU”.

If this is an option you are considering, speaking to a professional in the field should be the first step you consider.

Speak to Us or Comment!

If you have concerns about your Spanish property investments and how this affect your tax position, we would like to hear from you. Get in touch with us today or let us know your thoughts in the comments section below.

Liked this article? Try reading:

A Seafarers Guide to Buying Property in Spain

Any advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.