Tax & Yachting: The dangers of ignoring it.

- Authors

-

-

- Name

- Patrick Maflin

-

In the wake of one of the worst financial crisis since the Great Depression, the Federal Reserve decided to roll out an initiative known as FATCA. The OECD (Organisation for Economic Co-operation and Development) were quick to follow suit and in 2014 introduced the Common Reporting Standard (CRS). Both of these initiatives were designed to combat tax evasion.

FATCA & CRS were both implemented to facilitate the Automatic of Exchange of Information. Banks are now required to hold on record Tax Information of account holders, primarily their tax identification numbers and address.

There are now 149 members of the Global Forum, all committed to preventing tax evasion. As of 1st September 2017 50 member states began sharing details of account holders held on record. There are another 50 member states that will be sharing information as of 2018.

WHAT DOES THIS MEAN FOR ME?

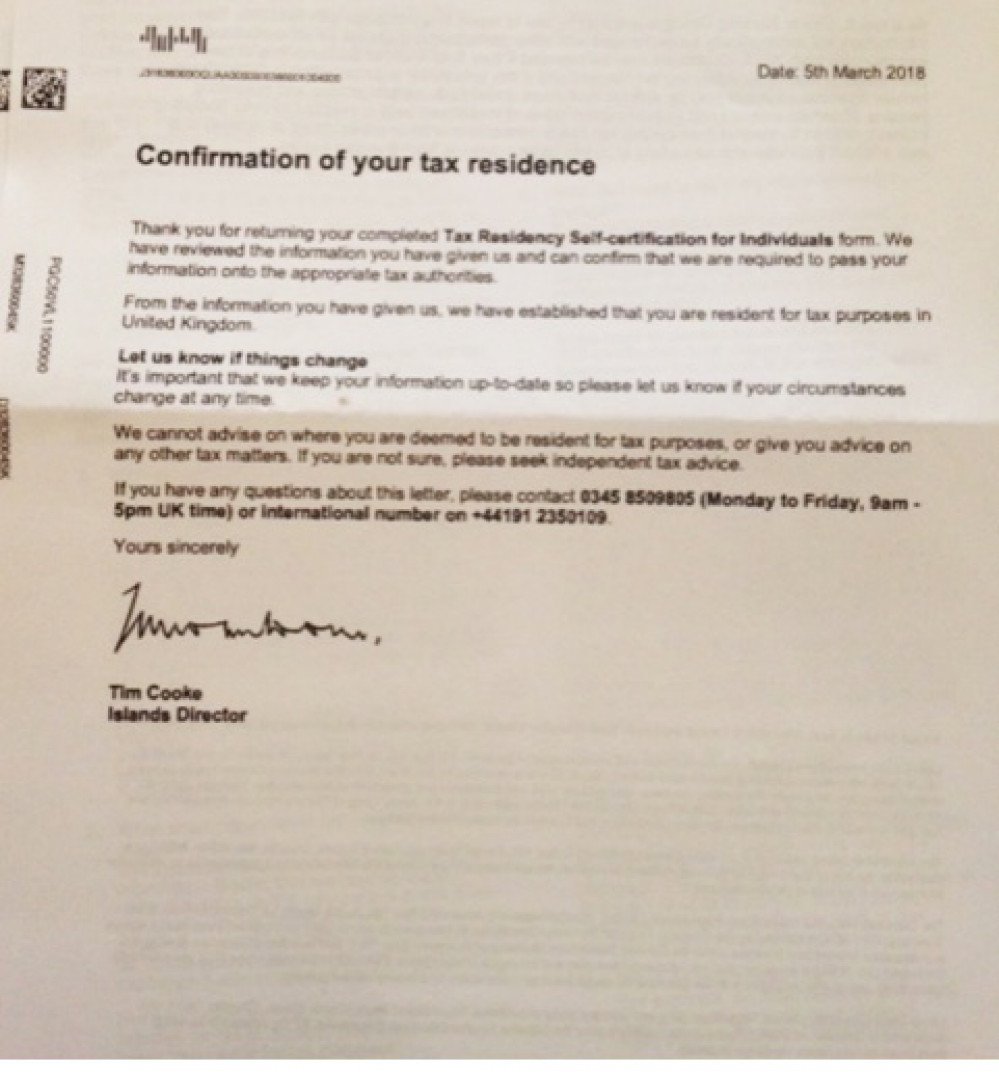

If you bank offshore, as many yacht crew within the industry do, you will undoubtedly receive a letter from your bank asking you to confirm where you are tax resident. Whether or not you are sure of exactly which country this is for you, you are required to complete the paperwork and return it, usually within a restricted time frame. As a direct result of these changes, those who have chosen to avoid this topic up until this point can no longer feign ignorance and use this as a legitimate excuse.

As shown in the letter featured in this article, banks are now not only requesting the information to have on record but also sharing it whereas at the outset it was alleged that information would only be shared if clients were not forthcoming.

Our advice to those who are still unsure of their tax residency is to seek professional advice and be proactive.

Any tax advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.