How to React to HMRC Investigations

- Authors

-

-

- Name

- Patrick Maflin

-

Image source: https://pixabay.com/photos/burnout-programmer-computer-stress-2154557/

With HMRC having received their first batch of information under the Common Reporting Standard (CRS) in September 2017, the repercussions of the new laws are now truly becoming clear.

With many yacht crew finding themselves in a situation in which they are domiciled in the UK, but will spend the majority of their time elsewhere in the world, fear is beginning to grow amongst crew with regard to the potentially being caught in this newly established net.

In this article we discuss what to do if you become subject to an HMRC investigation and how to react.

Read on to find out more or click a jump link below to skip to a chapter that interests you.

Chapters

- Do It Right From The Start!

- If A Letter Comes Through Your Door

- Step 1

- Step 2

- Step 3

- Step 4

- Summary

- Contact Us or Comment!

Do It Right From The Start!

As concerns grow and crew find themselves looking over their shoulders, it’s important to state that there is one key step to take which will allay this initial unease.

Arrange your tax affairs correctly from the outset!

In the world of taxation, you can only plan forwards.

There is no option to plan retrospectively once HMRC have begun their investigation, so doing it right ahead of time is what we would advise every crew member we speak to.

If you’re unsure what you need to do in order to plan ahead, you can make an enquiry here and you will hear from one of our industry leading experts shortly afterwards.

Image source: https://commons.wikimedia.org/wiki/File:HMRC_Self_Assessment_tax_return.jpg

If A Letter Comes Through Your Door

Whilst planning ahead will always be the best option, there will be some who were unaware of their obligations and as such find themselves in a position where they haven’t managed to do so.

If this is a position you find yourself in personally, some simple advice can be found in this article.

Step 1

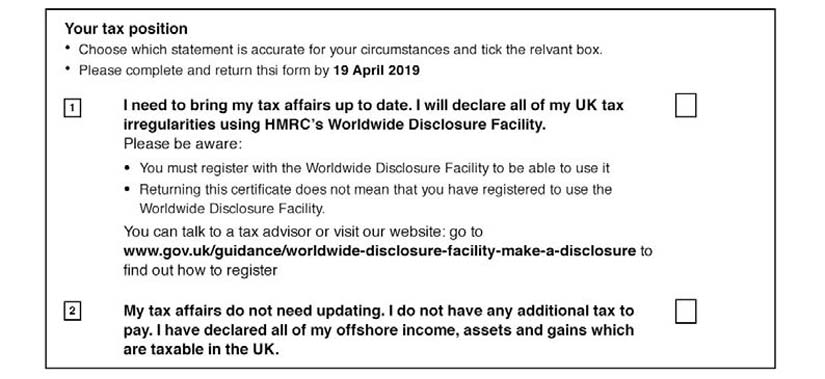

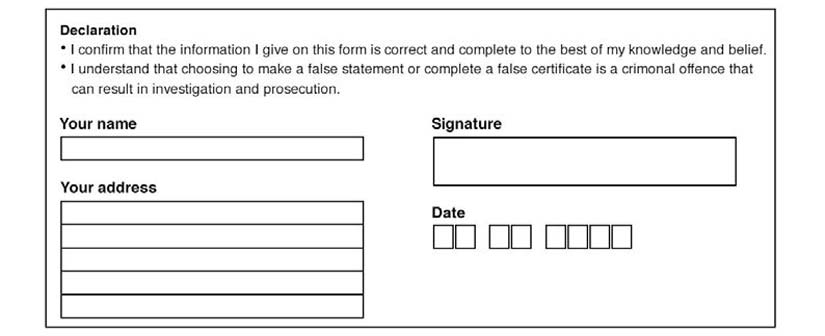

When you receive a letter from HMRC enquiring as to your tax position, the first step is to read the letter very carefully.

Whilst there is still a possibility that the letter you have received has been produced generically, this is an important document and it’s essential you understand exactly what is being asked of you.

Holding cash and assets overseas can be a trigger for an HMRC enquiry and as such, yacht crew find themselves at a higher risk of initial questioning than individuals in other industries.

Once you have understood the question, you put yourself in a much better position to give an answer.

Step 2

Communicate promptly.

Once HMRC have made initial contact with you, it is highly important that you are prompt in your communication with them.

If you’re unsure why you have come to their attention, consult with a professional who will be able to read through the document and advise how best to proceed.

Make sure that when you do respond, you are honest, open and transparent about your situation as uncertainty will only serve to cause more confusion and add more time before a resolution is reached.

Step 3

Double check on your previous declarations.

Whilst it may be a completely innocent mistake, once a communication channel is opened, it is necessary to be 100% certain that your previous declarations are accurate.

If you have used a professional advisor to lodge your previous tax returns, they should be more than willing to assist you in the process, often with no additional fee incurred.

Step 4

HMRC are likely to set you deadlines in terms of the communications you agree or any additional fees and charges to be made to your account.

Make a note of these deadlines and ensure they are not missed.

Previously missing deadlines will only serve to elongate the process and any charges issued will likely increase as the investigation develops.

Summary

The least stressful course of action will always be to plan ahead.

By doing so you will be more than likely to have the answers to any questions before they are asked which saves a lot of anxiety at the point where any initial communication is received.

Contact Us or Comment!

If you do find yourself in a situation where an investigation has begun or channel of communication has been opened, it is advisable to consult a professional who will be experienced in dealing with similar situations to your own.

Get in touch with us today or let us know your thoughts in the comments section below.

Liked this article? Try reading:

The Importance of Voluntary Disclosure

Any advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.