Are You Really a Non-Resident for Tax Purposes?

- Authors

-

-

- Name

- Patrick Maflin

-

Image source: https://www.pexels.com/photo/selective-focus-photography-of-person-holding-passport-with-ticket-1266017/

You may be one of the many crew who believe that they are in a position of non-residency, but it this really the case?

If you were to be questioned regarding your tax affairs, are you confident that you would have the evidence you need to show the tax authorities that you haven’t met any of their residency tests?

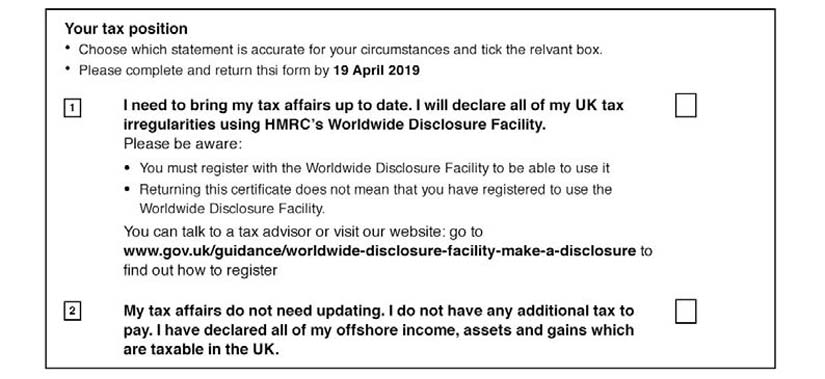

The only way to be truly confident of this as a UK resident, would be to obtain a Certificate of Tax Position or its equivalent.

Thus far this is not something the majority of seafarers have done.

Read on to learn why seafarers who haven't acted need to do so now or click a jump link below to skip to a chapter of your choice.

Chapters

It’s Time To Take Notice!

2017 saw the implementation of new anti-tax evasion policies which have given tax authorities worldwide the ability to gain access to information regarding the offshore holdings of all account holders.

The Automatic Exchange of Information (AEOI), has been a breakthrough for tax authorities in their ongoing search for previously undetectable tax evasion and unfortunately the holdings of seafarers have fallen under scrutiny as a part of the process.

Alarmingly, failure to comply with this legislation by providing up-to-date personal information has led to 8000 Lloyd’s International Accounts being frozen in Jersey as reported in recent weeks, as highlighted in our recent article

HMRC and tax authorities worldwide have been in receipt of information about the holdings of those who they believe may be resident in their jurisdiction since September 2017.

Areas of the globe where account activity is undetectable are now few and far between, with most of those that do remain being financially blacklisted locations such as Nigeria which is by no means a favourable option.

Therefore, failure to declare offshore holdings as a resident, or holding an uncertain position of worldwide non-residency, is no longer a viable option.

As the reporting of information reaches those in power, it may be only a matter of time before your undeclared holdings become visible, at which point penalties or fines are sure to be furnished.

How To Get Ahead

Some seafarers may find themselves in a unique position with the opportunity to declare all or some of their income from working at sea without the necessity of paying tax on it.

In the UK, the Seafarers Earnings Deduction means that you are able to back-date your taxes without paying tax on your earnings, whilst also avoiding penalties.

There are also opportunities to claim exemptions in the USA, South Africa, Spain and more for those who meet the qualifying criteria laid out.

There are still large numbers of crew who fail to file a tax return each year, even with the opportunity to do so without incurring a tax liability.

Whilst you may believe yourself to hold a position of worldwide non-residency, and this may well be the case, it is your duty to be able to evidence this should the tax authorities wish you to do so.

Image source: https://pixabay.com/photos/taxes-tax-evasion-police-handcuffs-1027103/

What To Do Next

Given how important your tax compliance has now become, it is imperative that if you do believe yourself to hold a non-resident position, you are absolutely certain of this.

By taking professional advice on your situation you will be able to demonstrate when questioned that you have made your best effort to comply with the laws as they stand.

You may, like many, be surprised to find that despite spending little time in your home country, you do in fact remain a resident for tax purposes.

In this case, the longer you wait before bringing your tax affairs up to date, the larger the penalties will likely be.

Even if you are able to sufficiently demonstrate that you have not met any of the residency tests in place, you may still have income to declare.

Whilst your employment income may be of no interest to the authorities, it is important to remember that in most cases, income from onshore sources should be declared to the relevant authorities.

If you have any questions or would like advice on your tax or residency position get in touch with us today.

Speak to Us or Comment!

If you're a seafarer and have concerns about your tax position and residency status, we want to hear from you. Get in touch with us today or leave a comment in the section below.

Liked this article? Try reading:

The Importance of Voluntary Disclosure

Any advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.