New Zealand IRD Acts Upon First Batch of Information on Undeclared Income

- Authors

-

-

- Name

- Patrick Maflin

-

Image source: https://pixabay.com/photos/visa-travel-passport-document-3294951/

In 2014, new legislation was introduced named the Automatic Exchange of Information (AEoI) which forces financial institutions to share information about their client’s holdings with tax authorities around the world.

The repercussions of this are now beginning to be felt by crew who had previously avoided their tax obligations in terms of declaring their income from yachting.

Letters have been sent to thousands of individuals whom the Inland Revenue Department (IRD) consider may be tax residents of New Zealand, asking them to declare their offshore holdings to the IRD or risk facing further investigation.

These recent developments highlight the importance of ensuring that you are in a position of tax-compliance, and if you are not, to take measures to ensure that you are.

In this article we take a look at the letter being received by those identified by the IRD, and how you must act to avoid repercussions.

Read on to find out more or click a jump menus below to skip chapter.

Chapters

- What Information Can the IRD Access?

- Have You Received a Letter From the IRD?

- Speak to Us or Comment!

What Information Can the IRD Access?

Since September 2018, the IRD have been receiving information about both the onshore and offshore holdings of individuals with ties to the country.

Holdings in areas of previous anonymity such as Luxembourg, Mauritius, the Cayman Islands and the British Virgin Islands are now entirely transparent to tax authorities.

Altogether, 109 countries have agreed to the legislation.

Each participating country will annually exchange with other countries the below information about their clients:

- Name, address, taxpayer identification number (TIN), date and place of birth of each reportable individual

- Name and identifying number of the financial institution where the balances are held

- Account number

- The balance or value of the account at the end of the reporting period (or at the date of closure of the account)

- Any capital gains, including dividends and interest

Furthermore, the information that the IRD have now received will highlight any wrongly or under declared income, so it is vital that you have been accurate in previous declarations of your holdings.

Image source: https://pixabay.com/photos/chart-graph-finance-financial-data-2785902/

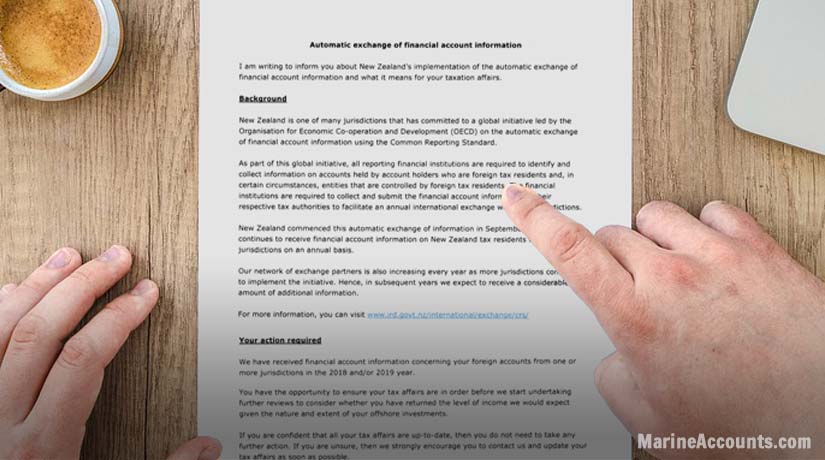

Have You Received a Letter From the IRD?

If you have received a letter from the IRD or any other tax authority requesting information similar to the one below, it is imperative that you act now.

Voluntarily disclosing your non-tax compliant holdings will ensure that the IRD views your case in a significantly more positive light than if their investigations were to discover any undeclared income.

Speak to Us or Comment!

If you are unsure of your obligations or would like clarification on your individual position, our tax consultation service can give you a clear and easy to understand assessment to make sure that you are tax compliant.

Get in touch with us today or let us know your thoughts in the comments section below.

Liked this article? Try reading:

Yacht Crew Tax & Financial Information - Your Ultimate Guide

Any advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.